Solana Ecosystem Update: A New Dawn for Institutional Adoption

Solana, one of the leading blockchain protocols, has recently made headlines as its total value locked (TVL) has surpassed $6 billion, reaching its highest point since January 2022. This resurgence signals not just a recovery from previous setbacks but a growing confidence in Solana as a viable platform for institutional blockchain adoption. Recent developments, including announcements from major players like Franklin Templeton and CitiBank, suggest that Solana could be at the forefront of driving digital asset adoption in the coming years. The prevailing sentiment surrounding Solana could be a key driver of digital asset adoption. This article aims to bring you up to speed on these exciting developments.

Key Developments at Breakpoint 2024

At the recent Breakpoint 2024 event at TOKEN2049 Singapore, Solana showcased its evolution into a leading candidate for institutional engagement. Despite initial skepticism regarding its suitability for tokenizing real-world assets (RWAs), Solana has established itself as a serious contender. Traditionally, networks like Avalanche and Polygon were preferred for their customizable sub-chains that allow institutions to maintain regulatory compliance. However, Solana’s commitment to tokenization on its public Layer 1 has gained traction due to its ability to handle low-cost, high-volume transactions efficiently.

Notable partnerships have further cemented Solana’s position. Visa’s collaboration for stablecoin settlements and PayPal’s launch of the PYUSD stablecoin on the platform are significant milestones. Recently, Franklin Templeton announced plans to tokenize a mutual fund on Solana, while Citi Bank is exploring its potential for cross-border transactions and smart contracts. This institutional trust marks a pivotal shift, especially as traditional finance (TradFi) institutions begin to favor Solana over Ethereum.

Trading Volume and Memecoins: A Double-Edged Sword

$SOL’s on-chain trading volume skyrocketed 50% outpacing $ETH.

$SOL’s on-chain trading volume skyrocketed 50% outpacing $ETH.

Solana has also experienced a notable increase in trading activity, with volumes climbing 50, surpassing Ethereum. Much of this growth can be attributed to the rising popularity of memecoins, which now account for 40% of Solana’s trading activity. The memecoin launchpad pump.fun, where anyone can trade newly minted memecoins, has emerged as a significant player, dominating 35% of decentralized exchange (DEX) transactions on the network.

In general, Solana memecoins have experienced a meteoric rise due to:

- Low fees: Low transaction fees on the Solana network make it accessible for a wide range of users who can easily trade without incurring significant costs and notably lower than other blockchains such as Ethereum.

- Scalability: Ability of the Solana architecture to support the large-scale use of the blockchain without significant impact to transaction costs.

- Community and Ecosystem: Solana-based memecoins have vibrant communities and ecosystems, attracting developers and enthusiasts interested in experimenting with new tokens and dApps.

Solana’s DEX buy volume distribution, showing a huge share of volume consistently captured by Memes and Low Cap tokens.

Solana’s DEX buy volume distribution, showing a huge share of volume consistently captured by Memes and Low Cap tokens.

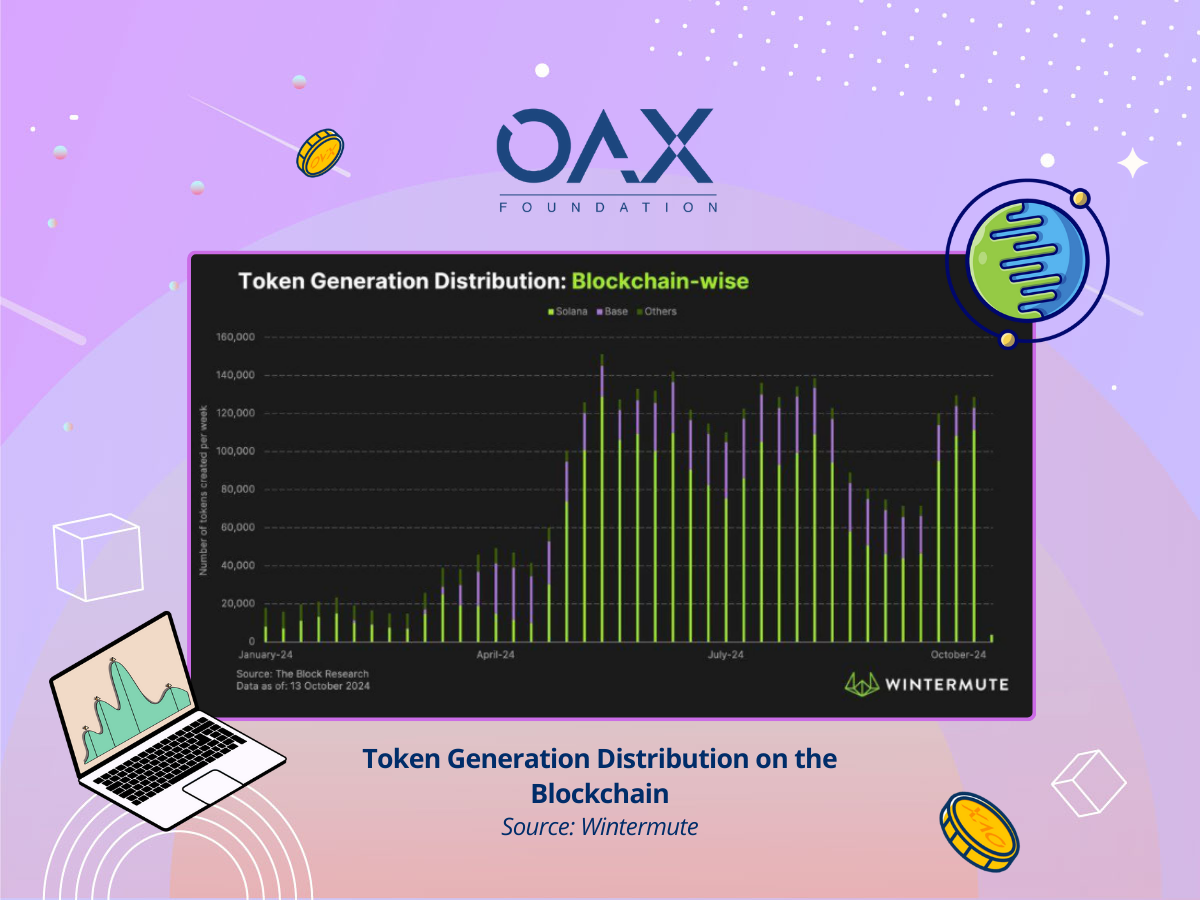

Additionally, Solana has captured 86% of the market share in token generation, with weekly production rising to 110,000 tokens. While some analysts speculate that the memecoin frenzy could fuel a bull run for Solana in 2025, concerns about the sustainability of this growth persist, especially given the network’s history of outages. Despite these challenges, Solana’s resilience is evident as it continues to innovate and attract attention. In response to the increasing popularity of memecoins, Notifs offers a specialized portfolio tracking app designed to help users monitor prominent memecoins including those on Solana. By adding these coins to your watchlist, Notifs provides real-time updates, enabling effective management and insight into this dynamic segment on the protocol.

ETF Prospects and Mobile Innovations for Growth

Following the approval of Spot Bitcoin and Ethereum ETFs, as featured in our previous articles, Solana is now on the verge of entering this arena. Brazil’s Securities and Exchange Commission has already approved a second Solana exchange-traded fund (ETF), set to launch in partnership with Hashdex. This move could significantly enhance Solana’s visibility and institutional appeal.

Solana’s commitment to a mobile-first approach is exemplified by the launch of the Solana Seeker smartphone, designed for crypto users with features like secure custody solutions and integrated dApp functionality. With over 140,000 pre-orders, the device aims to strengthen Solana’s presence in the handheld market and attract new users. Moreover, Solana has introduced a new Web3 handheld gaming device, aiming to provide seamless access to Web3 games bringing faster transactions and low fees. Along with the recent partnership with Google Cloud, an initiative called GameShift aims to integrate Web3 into traditional gaming via Google Marketplace. These developments indicate Solana’s commitment to expand in the gaming sector as well as leverage on the handheld market to penetrate market adoption.

Opportunities in Partnerships and New Use Cases

The recent collaboration with PayPal has propelled PYUSD’s market cap past $1 billion, driven by its integration with Solana and the introduction of yield incentives on decentralized finance (DeFi) protocols. This partnership underscores the potential for innovative use cases within the Solana ecosystem. Since its introduction, the supply of PYUSD on Solana has surged, exceeding that on Ethereum. The number of monthly active wallet addresses for PYUSD rose sharply, jumping from 9,400 in May to over 25,000 in July. Although the incentives fueling this growth are viewed positively, there are ongoing concerns regarding their long-term sustainability.

Additionally, Powerledger, an Australian energy tech firm, is integrating with Solana to explore regenerative finance opportunities. Such partnerships highlight Solana’s versatility and appeal across diverse sectors, further enhancing its growth potential.

Outlook: A Healthy Ecosystem with Obstacles to Overcome

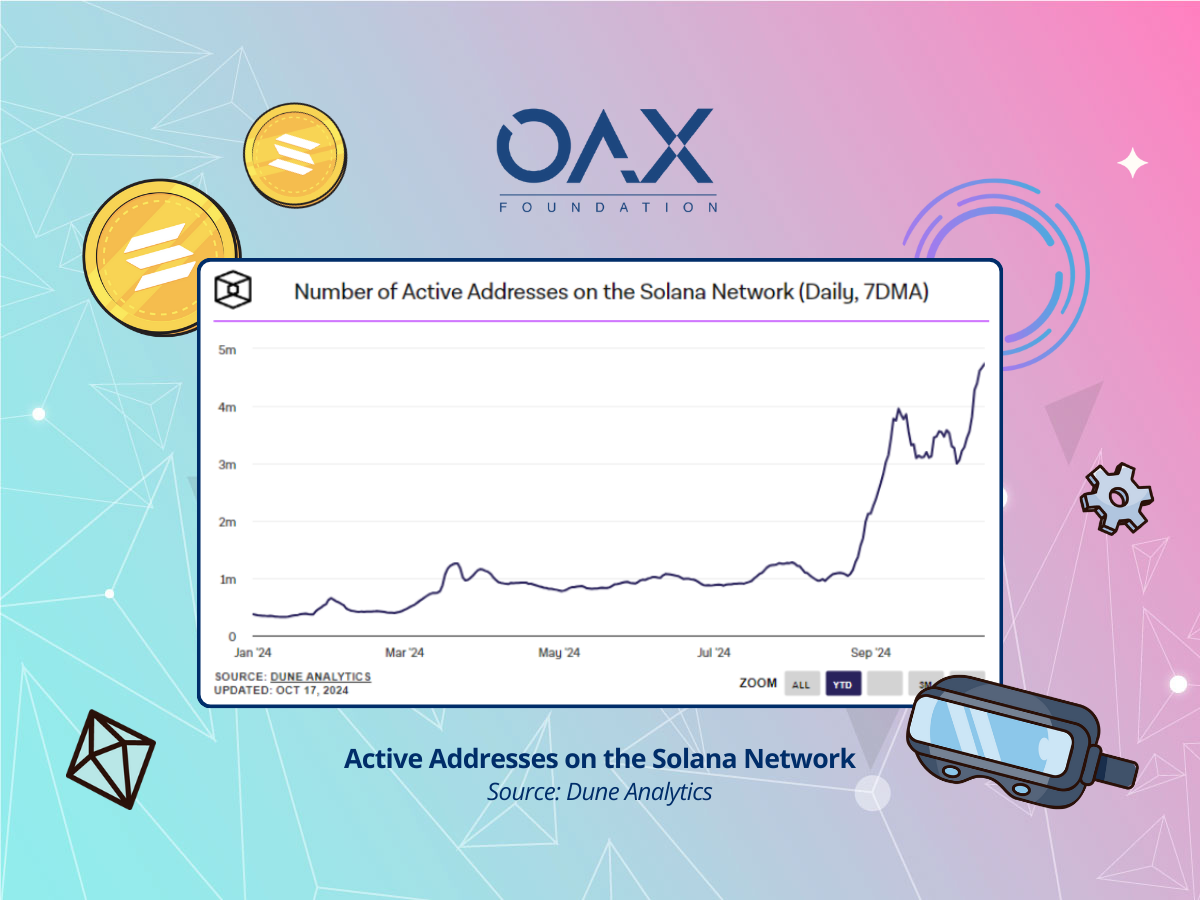

The distribution of Solana’s on-chain activity indicates a healthy and growing ecosystem, with a fast growing user base while concentrated among a small percentage of power users, the protocol yet to find ways to fully engage its users. Seeing focus on institution adoption and discovery of new use cases may potentially be the way forward such as partnerships with PayPal and Visa. However, the heavy reliance on DEX activity, risk of network outages and finite incentives, raises concerns about vulnerability upon market downturns.

As Solana continues to evolve, it remains to be seen how these dynamics will play out. With a palpable sense of momentum, Solana is poised not just for recovery, but potentially for transformative growth in the digital asset landscape.

The upcoming Solana Hacker House in Hong Kong offers an exciting opportunity to showcase emerging projects and innovation to solve the aforesaid challenges. The OAX foundation, headquartered in Hong Kong will be attending this event to explore collaboration. We look forward to sharing with our community a debrief of the “Blocktober” month in our community update.

OAX Team

Disclaimer: The above is an opinion piece written by an authorized author, but in no way represents the official standpoint of OAX Foundation Limited, nor should it be meant to serve as investment advice.