Stablecoins: Bridging the Divide Between Crypto and Traditional Finance

In recent months, the conversation around stablecoins has intensified, capturing the attention of regulators, fintech giants, and government entities exploring the issuance of their own digital currencies. The rapid evolution of this asset class is impossible to overlook, as it is set to reshape the financial landscape. In this article, we’ll delve into the origins of stablecoins, identify the key players leading the market, and explore the opportunities and challenges they face. Join us as we unpack these critical developments and their implications for the future of finance.

Where It All Began

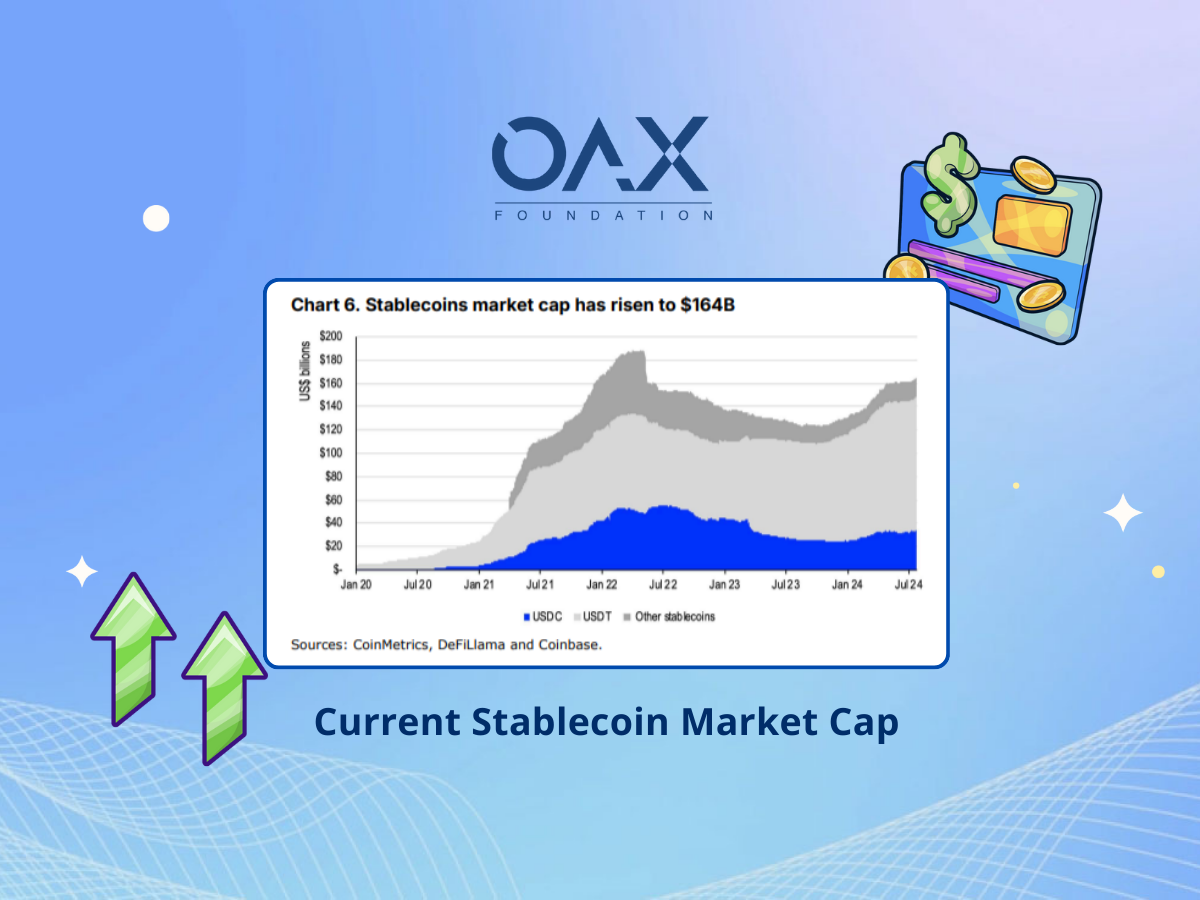

Stablecoins have rapidly established themselves as a pivotal asset class in the cryptocurrency landscape, gaining remarkable traction over the past five years. Designed to offer price stability and serve as a familiar medium of exchange, stablecoins address a fundamental challenge within the often-volatile crypto market. Although they first entered the scene in 2014, their prominence surged during the crypto boom of 2020, with total issuance skyrocketing from roughly $5 billion at the beginning of that year to over $180 billion by May 2022. A striking development in the stablecoin arena has been the surge in on-chain transaction volumes.

As of 2023, stablecoins settled an impressive $10.8 trillion in transactions, with $2.3 trillion linked to organic activities like payments and cross-border remittances. This trend positions stablecoins as significant players in the real economy, with the potential to disrupt traditional payment systems.

Who Are the Key Players?

In this burgeoning market, Tether (USDT) remains the dominant force, commanding a market cap of $116 billion—representing 69.6% of the total stablecoin market. Other notable contenders include USD Coin (USDC), BlackRock’s BUIDL, and PayPal USD (PYUSD). Conversely, some stablecoins like First Digital USD (FDUSD) and Ethena USDe have experienced declines in market capitalization, underscoring the volatility inherent within this segment.

Increased Regulation Discussions

Despite their potential, stablecoins face substantial regulatory challenges. The Financial Stability Board has emphasized the need for consistent regulations across jurisdictions to inspire user confidence and foster a predictable market environment. In the United States, two significant bills—the Clarity for Payment Stablecoins Act of 2023 (CPSA23) and the Lummis-Gillibrand Payment Stablecoin Act (LGPSA)—are currently under congressional consideration, proposing various frameworks for stablecoin issuers. Clear regulatory guidelines are crucial for the market’s growth and stability.

The regulatory landscape is also shifting. With the implementation of the Markets in Crypto-Assets Regulation (MiCA) in Europe, new compliance frameworks are taking shape. USDC has become the first MiCA-compliant dollar stablecoin, while Circle’s euro-backed EURC has also achieved compliance. Traditional financial institutions are increasingly engaging with stablecoins, as evidenced by initiatives from Societe Generale and Deutsche Bank, which are launching their own stablecoin projects.

Barriers to Adoption

Adoption remains another formidable challenge. Established payment networks like ACH in the U.S. and SEPA in the eurozone continue to dominate interbank fund transfers, with ACH settling a staggering $80.1 trillion in 2023. Credit cards also remain entrenched in consumer habits, imposing hefty fees that affect both retailers and consumers. While mobile payment systems are emerging, they often rely on existing banking relationships, posing barriers for lower-income users.

Growth through Integration

The opportunities presented by stablecoins for enhancing the global payments system are significant. With $45 trillion in fund flows from cross-border transactions, international commerce, and global remittances in 2023, stablecoins offer a means for lower-cost money transfers and faster settlement times compared to traditional banking systems. They are being integrated into major fintech platforms like PayPal, MercadoLibre, and Grab, thereby broadening their utility and appeal.

HK, US and UK

In regions like Hong Kong, stablecoin discussions are gaining traction, the regulatory body has shown signs of support through the sandbox initiative in July 2024. In the U.S., stablecoin issuers have become significant holders of U.S. Treasuries, underscoring their systemic importance. Competition in the stablecoin market is also intensifying, with BitGo announcing its USDS stablecoin launch for January 2025, and Coinbase introducing cbBTC for its Base layer-2 network. Meanwhile, fintech firms in the U.K., like Revolut, are exploring stablecoin offerings despite navigating regulatory challenges.

Emerging Markets

Recent data from a survey by Castle Island Ventures, Brevan Howard, Visa, and Artemis reveals a growing trend in stablecoin usage across five emerging economies: Brazil, Nigeria, Turkey, Indonesia, and India. Among 2,500 respondents, 57% reported increased stablecoin usage in 2024, with 72% anticipating further growth. Stablecoins now account for 50% of the value settled on public blockchains, surpassing Bitcoin’s 25%. In these emerging markets, stablecoins are primarily utilized for saving in USD, yield generation, and favorable currency conversion rates, rather than for speculative purposes, reflecting their increasing adoption and utility.

Outlook

As the payments landscape evolves, traditional banking systems and credit cards are increasingly pressured to adapt to changing consumer needs. Stablecoins, by offering price stability through pegging to the U.S. dollar, aim to bridge the gap between the volatile crypto world and traditional finance. Recent partnerships, such as those between Coinbase and Stripe, along with initiatives from Visa and Mastercard, indicate a growing acceptance of stablecoins.

The key question remains: will stablecoins cement their position as mainstream payment methods, or will regulatory hurdles and adoption challenges hinder its progress? The trajectory appears promising, but the future of these innovative financial instruments will ultimately depend on how well they navigate these complexities.

With the OAX Foundation headquartered in Hong Kong, a key financial hub, we are closely monitoring regulatory developments and sandbox initiatives to identify potential collaborations that will drive this space forward. Yet, for these digital assets to realize their full potential, clearer regulatory frameworks and improved user experiences are essential.

Based on a report by K33 Research, Stablecoin transactions are now comparable to - and potentially surpassing Visa.

Based on a report by K33 Research, Stablecoin transactions are now comparable to - and potentially surpassing Visa.

Disclaimer: The above is an opinion piece written by an authorized author, but in no way represents the official standpoint of OAX Foundation Limited, nor should it be meant to serve as investment advice.