DeFi 2024: Positioned for Sustainable Growth

Introduction

The world of decentralized finance (DeFi) has undergone a remarkable transformation in recent years. What was once a niche corner of the crypto ecosystem has now become a vibrant, multifaceted landscape. Gone are the days when DeFi was solely about trading and lending - today, we’re seeing the rise of innovative trends like liquid staking protocols, restaking, native yield generation, and the tokenization of real-world assets, boosting the adoption of the technology.

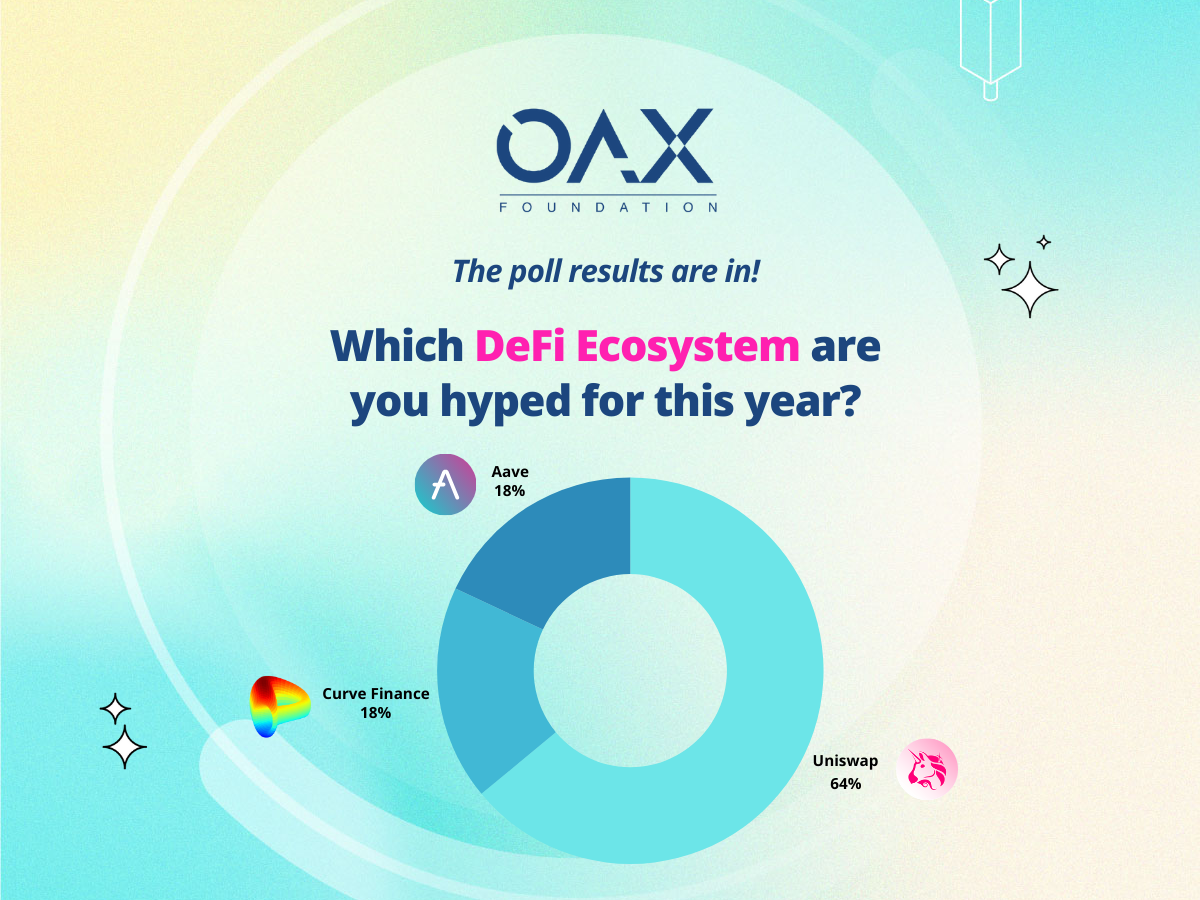

As the OAX Foundation, we’ve been closely following these developments, and we’re excited to share our insights on the current state of DeFi. Just last week, we hosted a community poll to find out what our community’s thoughts are on various DeFi ecosystems, and here are the results, with Uniswap taking the majority lead.

Moving on, in this writeup we’re looking to dive into various aspects of DeFi as a whole - From key metrics to emerging narratives, and the challenges and opportunities on the horizon, this article will explore indicators that may well suggest we’re on the verge of another “DeFi summer” - so buckle up, and let’s dive in.

Current State of DeFi

The crypto industry experienced a remarkable surge in the popularity and adoption of decentralized finance (DeFi) during the “DeFi Summer” of 2020. This period was marked by the rapid growth of innovative DeFi platforms and protocols, which attracted a significant influx of users seeking novel financial products and services. The total value locked (TVL) across crypto networks crossed the $1 billion milestone that year. However, despite the crypto market’s continued expansion, with TVL now exceeding $100 billion, the sense of excitement and rapid development seen in the DeFi space during that earlier period has not been replicated in more recent years.

More chains than ever

DeFi today isn’t just about borrow and lending - more multi chain than ever before The DeFi landscape has become significantly more diverse and multi-chain in recent years, moving beyond its initial dominance on the Ethereum network. While Ethereum still accounts for the majority of total value locked (TVL) across crypto networks, its market share has declined from over 95% during the DeFi Summer of 2020 to around 62% currently. A substantial portion of TVL is now distributed across rival layer-1 blockchains like BNB Chain, Solana, and Tron, as well as various layer-2 networks. Additionally, the emergence of Bitcoin-based decentralized exchanges and the introduction of token standards like Ordinals and Runes have expanded the DeFi ecosystem to incorporate Bitcoin-based applications, including those involving Bitcoin NFTs and memecoins, which now account for 1% of total TVL.

New narratives around yield and restaking

Moreover, the introduction of new DeFi protocols like Blast, which offers native yield on ETH, and EigenLayer, which pioneered the concept of “restaking” to unlock additional yield for Ethereum stakers, have further propelled the growth of yield-focused DeFi applications. In the first six months of 2024, EigenLayer’s TVL has surged from $1.3 billion to $17.9 billion, making it the second-largest DeFi protocol globally. Similarly, the newly launched Blast protocol has attracted $1.5 billion in TVL, making it the third-largest Ethereum layer-2 network.

MakerDAO leading the charge in RWA

The DeFi ecosystem has seen a significant shift with the emergence of real-world asset (RWA) tokenization, a trend that has been championed by the veteran DeFi protocol MakerDAO, which has transformed from a stablecoin protocol to one that provides crypto users exposure to off-chain assets like US Treasury bonds, with 38% (1.95b) of the total supply of its collateralized stablecoin DAI now backed by these RWA collaterals as of June 2024 - a move that has sparked debate, with proponents arguing it will help safeguard DAI from crypto market volatility, while critics contend it compromises the decentralization principles central to DeFi.

Challenges and opportunities ahead

The DeFi ecosystem faces several significant challenges that must be addressed for widespread mainstream adoption. Chief among these is the persistent issue of security vulnerabilities. The decentralized nature of DeFi platforms makes them attractive targets for malicious actors, as evidenced by the series of high-profile smart contract exploits that have led to devastating user losses. Compounding this, the regulatory environment surrounding DeFi remains uncertain, with divergent approaches emerging across jurisdictions. This lack of clear regulatory frameworks creates uncertainty and impediments for both developers and users. Additionally, scalability concerns plague many DeFi applications, as the underlying blockchain infrastructures struggle to accommodate surging user demand without incurring prohibitively high transaction fees and latency.

Despite these hurdles, the DeFi space also brims with tremendous opportunities that could redefine the financial landscape. Perhaps most impactful is the potential for financial inclusion - by eliminating the need for traditional financial intermediaries, DeFi platforms can extend banking and investment services to millions of unbanked and underbanked individuals globally. Moreover, the innovation in lending and borrowing models, enabled by peer-to-peer transactions, is disrupting the legacy financial system. The rise of decentralized exchanges (DEXs) has further empowered users by providing greater control over their digital assets. Underlying all of this is the programmable nature of DeFi, facilitated by smart contracts, which opens the door to novel financial instruments and use cases, from decentralized insurance to prediction markets.

Closing thoughts

While the DeFi industry may have struggled at times, it appears to be moving in a more positive direction with many DeFi projects now generating sustainable revenue streams, which suggests the sector is maturing and stabilizing after the earlier hype and volatility. Projects like Lido, MakerDAO, Uniswap, and Aave are demonstrating real business models and healthy user bases, rather than relying solely on token incentives.

With continuous advancements in security improvements, regulatory frameworks, user interfaces, and scalability through the integration of Layer 2 solutions. These developments have opened the doors for new use cases, such as the tokenization of real-world assets and the emergence of innovative applications in the creator economy we have covered in previous articles, all powered by the transformative capabilities of smart contracts.

The DeFi space is at a critical juncture, facing challenges that need to be addressed for sustainable growth, but the opportunities are equally compelling, offering a glimpse into a future where financial services are more accessible, efficient, and inclusive. The OAX Foundation is positive to have witnessed the evolution of the DeFi ecosystem, overcoming existing challenges and capitalizing on the myriad opportunities will be essential for realizing its full potential and driving the growth of decentralized finance.

Disclaimer: The above is an opinion piece written by an authorized author, but in no way represents the official standpoint of OAX Foundation Limited, nor should it be meant to serve as investment advice.