May 2024 Community Updates

This May has been a month of recovery for the digital asset market as we witnessed Bitcoin and Ethereum breaking key resistance levels. From the approval of spot Ethereum ETF in the United States to FTX’s announcement of how they plan to repay their customers, there have been a number of significant developments that have injected momentum into the crypto ecosystem, let’s dive in!

Spot ETH ETF Approval

The approval of spot Ethereum exchange traded funds (ETFs) in the US was expected to be a bullish event for Ethereum, but its price only increased by 1% before dropping 4% to $3,700 level. We are witnessing prices to hover in the high $3K range post approval as we speak. This “buy the rumor, sell the news” phenomenon is similar to what occurred when spot Bitcoin ETFs were approved in January. However, MicroStrategy founder Michael Saylor believes the approval of spot Ether ETFs is actually good news for Bitcoin, as it will strengthen the crypto industry’s political power and serve as another line of defense for the largest cryptocurrency. Saylor previously thought there was a slim chance of SEC approval, but now sees the move as accelerating institutional adoption and leading to mainstream investors allocating a portion of their portfolio to the crypto asset class, with Bitcoin receiving the majority.

FTX Creditor’s Arrangement

Despite the current Bitcoin price leaning close to $70K, FTX customers seeking higher Bitcoin prices for repayments have been denied by a U.S. bankruptcy judge. The judge ruled that the USD calculation date for crypto asset pricing will remain November 2022, when Bitcoin’s price was $16,871. As a result, FTX’s bankruptcy estate will only repay customers based on the Bitcoin price on that date, meaning customers will receive the USD equivalent value of their crypto holdings plus nominal USD interest. However, FTX plans to repay creditors up to $16.3 billion, which analysts believe could create a bullish overhang and increase buying pressure in the market. scalability and functionality.

AWS: Strategic Move in AI and Web3

The OAX Foundation is pleased to attend the AWS Summit in Hong Kong, where the focus was on the convergence of generative AI and Web3. From analyzing smart contracts to reducing complex and time-consuming tasks, the event highlighted the challenges of evaluating information and the importance of user-friendly analytics. We were impressed by the event’s emphasis on natural language processing, personal assistance, and AI-driven analytics, all of which aim to deliver valuable insights for users. Meanwhile, leading exchanges like OSL and Hashkey discussed their adoption of AWS services in the blockchain space, showcasing the benefits and supporting the thriving of this ecosystem.

However, the risks associated with AI cannot be ignored. The recent controversy surrounding OpenAI’s and a well known celebrities’ voice underscores the power of deep fakes and the disputes they could bring. Users in this world need to be ever vigilant, exercising judgment and validating the authenticity of AI-generated content as we have previously discussed the ‘Goods and Bads of AI’. We do urge you to read into how to do your own research in the crypto world and maintain a critical eye when navigating the rapidly evolving landscape of AI and Web3.

What’s Happening in Our Community

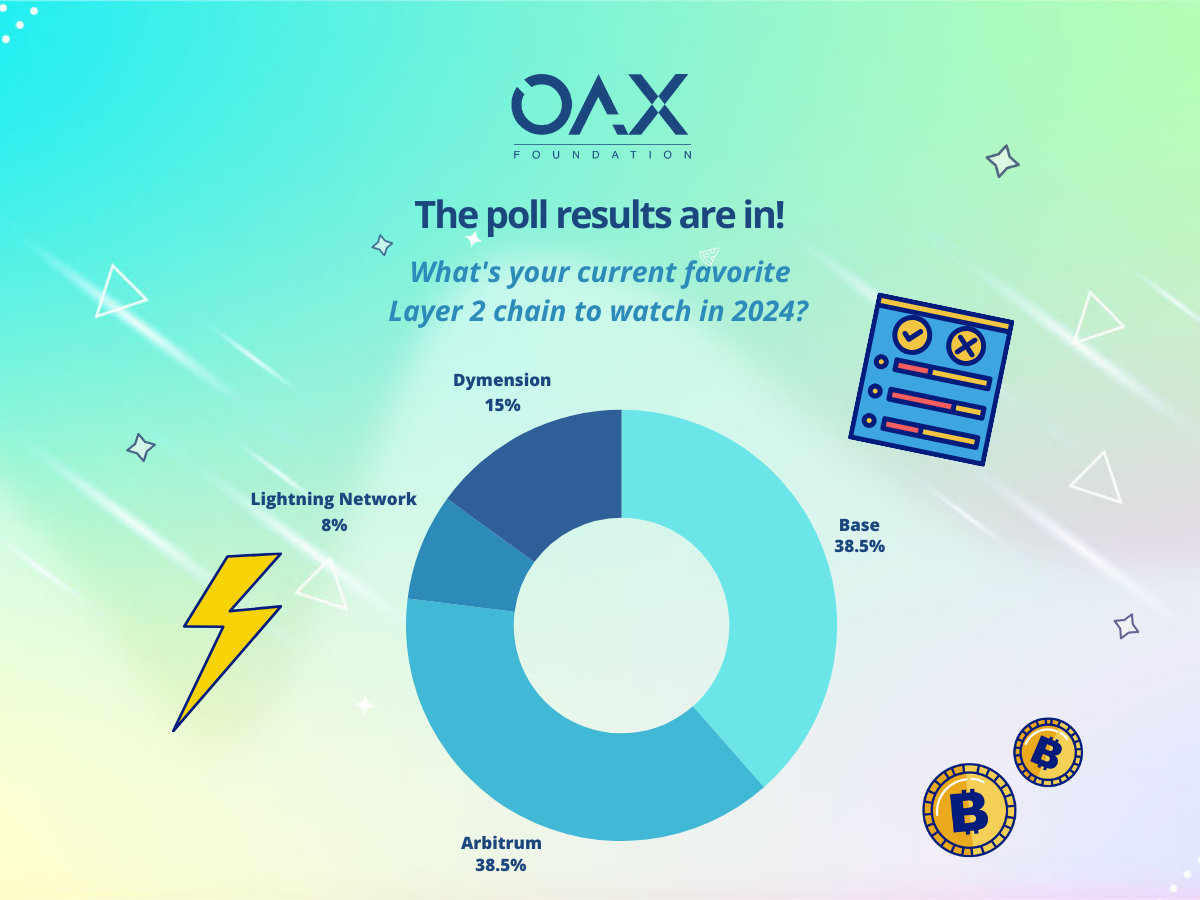

As we’re always keen to hear from our community, we’ve recently launched a poll to see what up-and-coming Layer 2 projects and chains that you all are excited about. Well, the results are finally in - and it seems that it’s a close call between Base and Arbitrum!

We’ve previously touched on the recent growth of the Base ecosystem as well, so the results aren’t surprising to us. What other chains are you keeping an eye on? Reach out to us via Telegram anytime and we’ll be happy to consider covering it in our content pipeline.

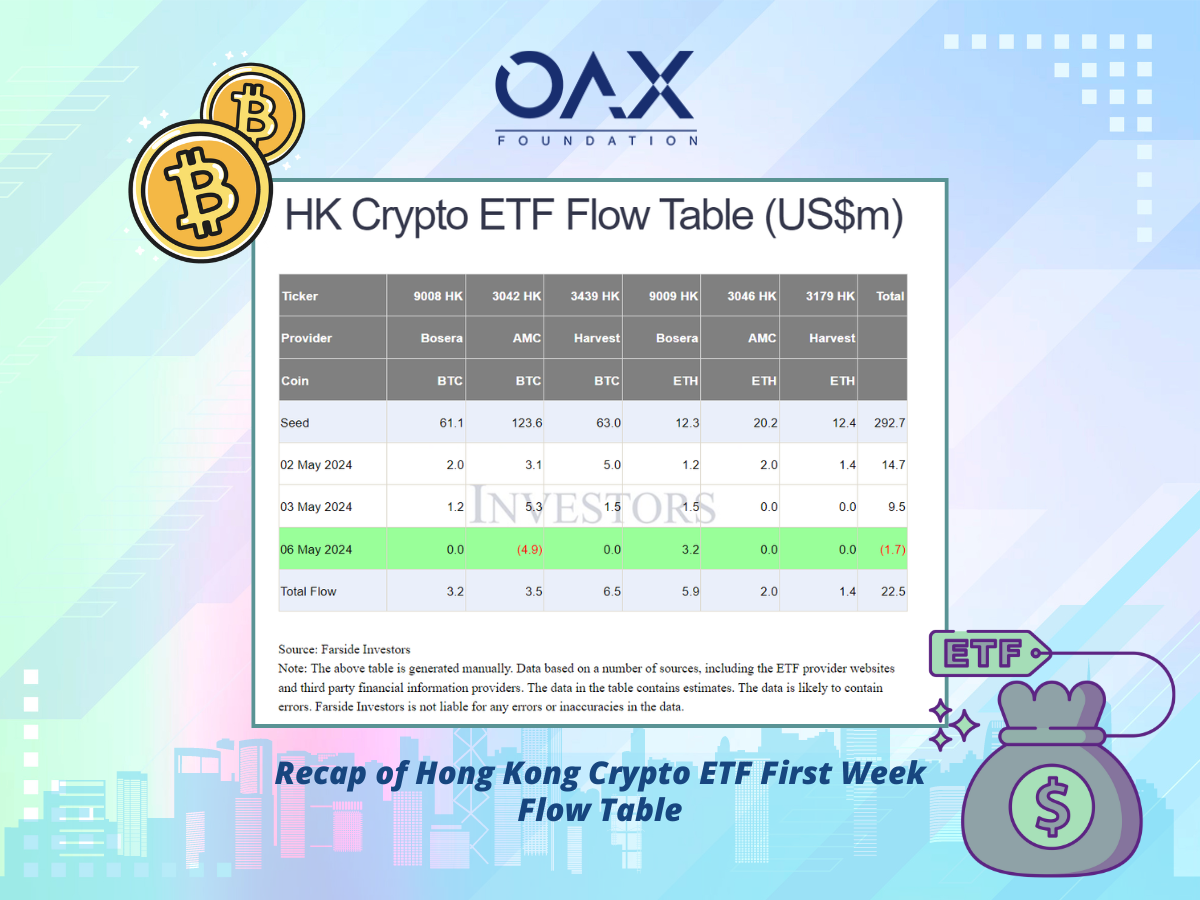

Last but not least, we covered the Ethereum spot ETF approvals earlier in our community update and while excitement is still brewing both in Hong Kong and globally, we’d like to highlight that you can easily keep watch of Crypto ETFs in the US via Notifs App. With the market seemingly on a recovery these days, now is as good a time as any to keep a closer eye on all your digital assets - not just crypto ETFs too!

For an easy way to learn more about OAX Foundation and join our community channels, feel free to scan the QR code below!

OAX Team

Disclaimer: The above is an opinion piece written by an authorized author, but in no way represents the official standpoint of OAX Foundation Limited, nor should it be meant to serve as investment advice.