Will Base L2 Sustain Its Momentum as a Rising Star Infrastructure?

In this blog, we delve into the explosive growth and future prospects of BASE, a layer 2 platform under Coinbase. Over the past month, the BASE ecosystem has experienced a remarkable surge, with over 4.75 million transactions and more than 400,000 sign ups in a short month. This frenzy of activity can be attributed to the skyrocketing popularity of memecoins. Through this article, we aim to explore the reasons behind this surge, examine its subsequent trajectory, and highlight the crucial factors that demand attention amidst this extraordinary growth.

What’s causing the rise?

The surge in activity on the Base blockchain can be attributed to the explosive popularity of meme coins. Tokens like TOSHI, TYBG, NORMIE, and BRETT have witnessed astounding price increases, resulting in cumulative trading volumes surpassing $1 billion.

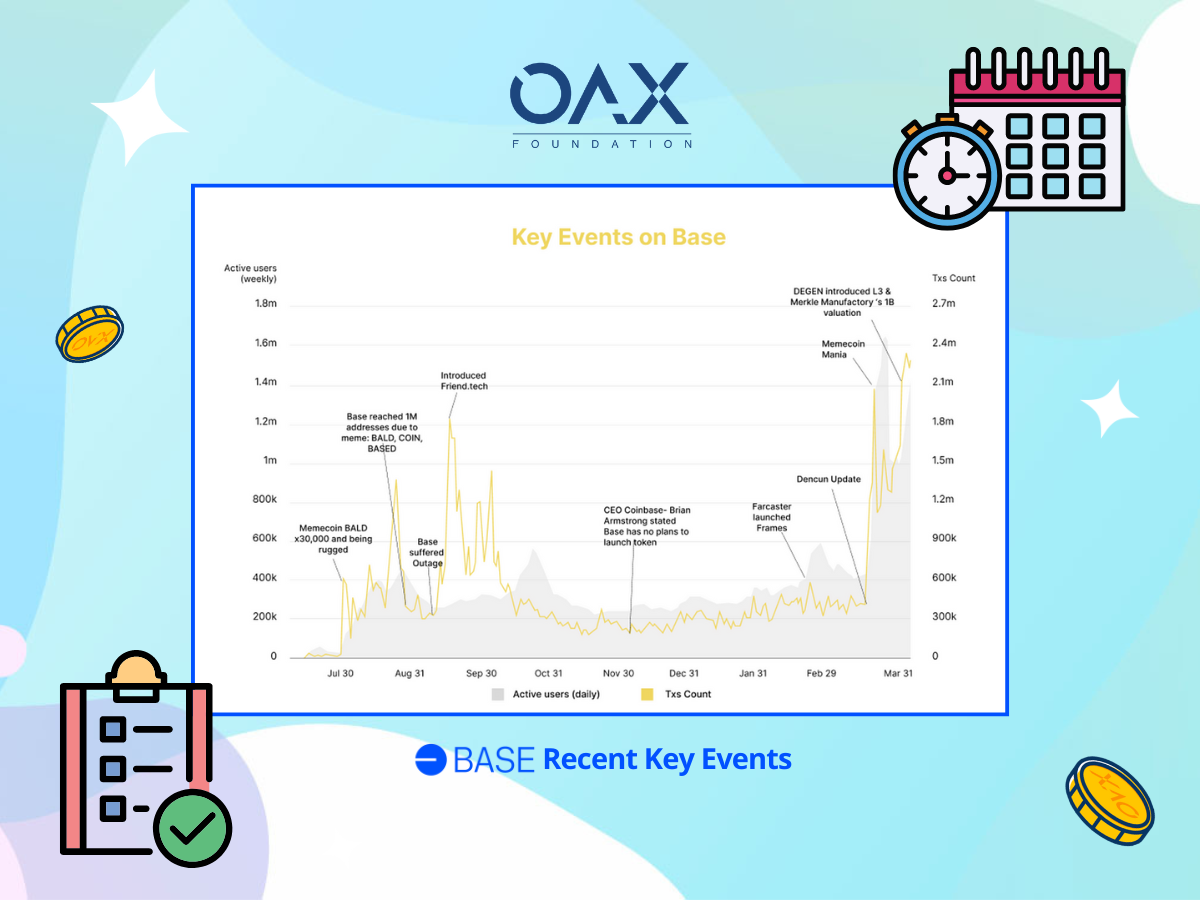

Source: Nguyen Viet Phong, Medium

Source: Nguyen Viet Phong, Medium

Further basing on the timeline of Base events above, Base gained significant traction and momentum from the memecoin mania. This phenomenon has propelled Base to experience a significant surge in transactional activity, the emergence of numerous unique addresses, and a substantial amount of locked funds. This remarkable growth, coupled with the advantage of direct access from Coinbase, positions Base as an attractive choice for new retail users, potentially making it their first foray into blockchain networks.

Moreover, the trend has spurred the migration of other memecoins to Base, further amplifying its expansion. Nevertheless, the widespread appeal of meme coins has presented certain obstacles, notably the issue of elevated gas fees and network congestion, which has been further intensified by the participation of trading bots. The majority of the transactions originated from meme coin trading, with trading bots specifically programmed to acquire tokens shortly after their release, contributing to network congestion.

Concerns, vulnerabilities and losses

After reaching its peak on April Fool’s Day, the frenzy surrounding memecoins has subsided. Furthermore, concerns regarding the legitimacy and security vulnerabilities of many memecoins have emerged. While some security flaws may suggest potential illicit activities, they could also stem from the limited knowledge of memecoin creators regarding proper security procedures. This is especially true for tokens launched as jokes or to mock the industry. The situation highlights the challenges faced by projects with limited resources, as they may lack the ability to hire security experts or conduct independent assessments of their smart contracts. Additionally, the practice of duplicating existing tokens further perpetuates the replication of flaws across various projects.

In the recent weeks, we saw memecoins suffering heavier losses than Bitcoin during sharp downturns in the recent weeks. The native token of a new Layer 3 network dubbed “Degen” (DEGEN) on Base, suffered the most, witnessing a 26% drop in market cap to $436.5 million.

Closing thoughts

While some industry watchers appreciate the memecoin rally for bringing new investors into the space, others argue that these ecosystems may have less tangible value compared to more established cryptocurrencies like Bitcoin and Ethereum. The OAX Foundation believes that the memecoin trend has undoubtedly pushed infrastructure projects to new heights, but it has also sparked reflection surrounding the balance between utility and intangible value in these fungible assets. It is more important to consider whether the hype surrounding memes is merely a means to gain popularity or an opportunity for the industry to address broader security vulnerabilities within the memecoin ecosystem. The OAX Foundation urges users to remain cautious and not overlook the flaws present in many projects. Conducting thorough due diligence before investing is essential.

Disclaimer: The above is an opinion piece written by an authorized author, but in no way represents the official standpoint of OAX Foundation Limited, nor should it be meant to serve as investment advice.